How would it feel to send money to someone by just typing in their debit card details and paying with your card?

In this article, you will discover the best card to card money transfer services in 2024. These are the services I have personally used, and I believe they are the best.

You may also like reading:

TransferGo Review (2024) | Best Money Transfer Speed, Rates & Fees

TransferGo vs Wise (TransferWise) | Which Service is Better in 2024?

How Card to Card Transfers Work

A card to card money transfer means sending money from one card (debit, credit, or prepaid card) to another, typically a debit card.

When sending money to a card, you need to enter the recipient’s card details such as the name, card number, and expiry date. Money is transferred in seconds and gets credited to the bank account to which the card is linked.

Card transfers are the easiest way to send money to someone since you only need to have card details to carry out the transfer. It’s also a quick way to transfer money.

To send money from one card to another, you need a money transfer service that offers this option. Remitly, Paysend, and TransferGo are some of the best companies to use when making a card to card money transfer.

Pros and Cons of Card Transfers

Here are the benefits and drawbacks of sending money from one card to another.

Pros

- Money transfers typically happen within a few minutes.

- When transferring money, fewer details are needed.

- Debit card payments may be cheaper than other forms of payment.

- When there isn’t enough money to cover the transfer, using a credit card may be helpful.

Cons

- In comparison to other payment methods, it is typically more expensive.

- It is not common to send money cards.

- Paying with credit cards may lead to debt.

3 Best Card to Card Money Transfer Services

1. Remitly

Remitly is a remittance company based in the United States that offers international money transfers. It offers extensive coverage in terms of delivery destinations, sending money to more than 130 countries worldwide.

Remitly offers many transfer options, including card-to-card money transfers. Other transfer options include bank deposits, cash pickup, mobile money, and home delivery.

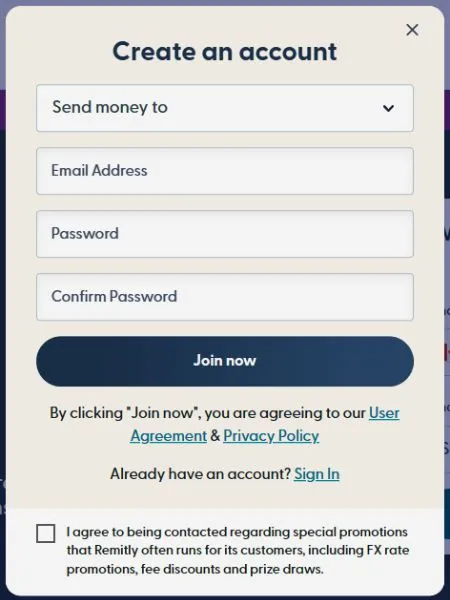

To transfer money between cards using Remitly, follow these steps;

1. Create an account on Remitly.

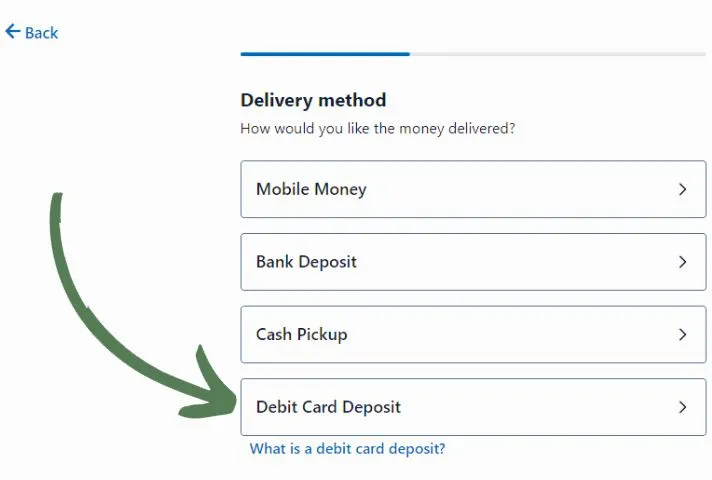

2. Log into your account and start a transfer. Select Express for the delivery speed so you can pay with your card. On the next page, select Debit Card Deposit as the delivery method.

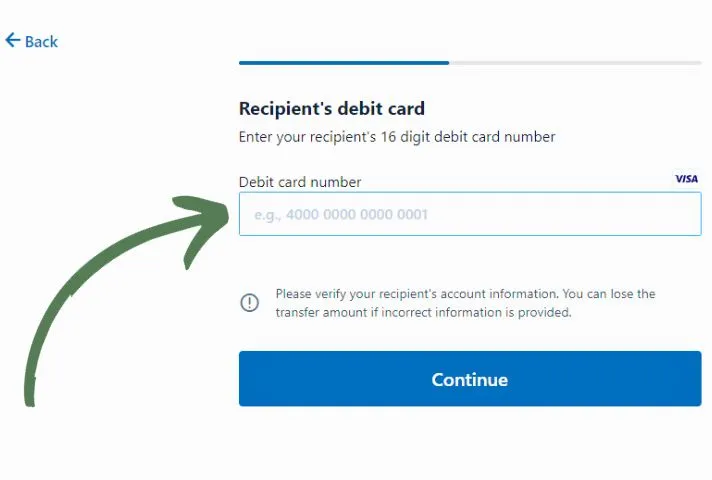

3. Enter the debit card information of the recipient and proceed to make payment to complete the transfer.

2. TransferGo

TransferGo is a money transfer company based in London that offers both local and international money transfers. It primarily provides services in Europe, Turkey, and the United Kingdom. You may use TransferGo to send money to several countries, including the US, Canada, and Australia.

If you are looking for a quick money transfer, you should consider TransferGo. It offers 30-minute or less quick money transfer services.

In addition to being arguably the quickest money transfer service, TransferGo also provides competitive transfer fees and exchange rates.

TransferGo provides multiple payment and delivery options, such as bank transfers, cash pick-ups, debit deposits, and mobile money transfers. However, the card to card money transfer service offered by TransferGo is our primary focus here.

Follow the steps below to send money from card to card TransferGo.

- Log into your account and press Transfer Money to begin the transfer.

- Enter the recipient’s country, the amount, and the preferred delivery time, then press Continue.

- Enter the recipient’s details.

- Select the debit/credit card delivery option, enter the recipient’s card number and expiration date, and press continue.

- Review.

- Pay for the transfer using your debit, credit, or prepaid card.

After making the payment, allow 30 minutes for the money to appear on the recipient’s card.

3. Paysend

Paysend is a reputable money transfer service that enables users to send money to more than 150 countries worldwide. On this list, Paysend is the easiest company to use for money transfers. You can send money in just three easy steps.

Paysend provides a diverse range of payment options, including card deposits. The company is known as the pioneer of card-to-card money transfers because it’s able to transfer money to cards in numerous currencies across different countries.

Paysend charges a fixed fee of $2 or the equivalent, which makes it an affordable option for transferring money. However, additional charges may apply due to fluctuations in exchange rates.

Paysend’s card to card money transfers are quick and straightforward. You only need to provide the recipient’s name and their 16-digit debit card number, and you’re good to go.

Conclusion

In this article, you will discover the best card to card money transfer services, which are a quick and simple way to send money to someone.

Card-to-card transfers are usually cheaper than other alternatives, but using credit cards should be avoided due to high fees.

There are several companies that offer card-to-card money transfers. Although some of the best options are mentioned in this post, it is always best to conduct your own research to ensure that you get the best deal. You can use tools like Monito to compare different money transfer providers.

Card to card money transfer: FAQs

Can you transfer money from card to card?

Yes, you can send money from card to card using Remitly, Paysend, or TransferGo.

How long do card to card transfers take?

In most cases, transfers take a few seconds to be completed. However, in some cases, it may take a few minutes to a day. Card-to-card transfers are faster because transactions are processed automatically.

Also, note that transfer speeds differ from one money transfer company to another.

How much do card to card money transfers cost?

Sending money from card to card is a quick way to transfer money, but it comes with higher fees compared to other money transfer methods. Card providers like Visa and Mastercard may charge payment processing fees, which raises the total fees further.

Credit card payments have higher costs compared to debit card payments, ranging from 1% to 4% of the transaction amount, whereas debit card transaction fees typically range from 0% to 2%.

Considering the higher costs involved in card transfers, it’s better to explore other less expensive alternatives first.