With the advancements in technology, money transfer services have become more accessible, faster, and cheaper. Though this is a good thing, deciding which money transfer service to use has become extremely difficult. In this article, we’ll compare two of the most popular money transfer services: Wise vs Western Union.

On one hand, there’s Western Union, the world’s oldest money transfer company that’s been around since the 1800s. On the other hand, there’s Wise (formerly TransferWise), a fintech startup based in New York. These two companies are similar in many ways, as they both offer international money transfer services. However, there are significant differences between the two companies. Before we get into the specifics, let’s take a look at the two companies.

You may also like to read:

TransferGo vs Wise (TransferWise) | Which Service is Better in 2023?

TransferGo vs Western Union 2023: Which Money Transfer Service Wins?

Meet the competitors: Wise and Western Union

Wise

Transferwise, rebranded as Wise recently, is a peer-to-peer money transfer service that aims at cutting high fees and slow processing speeds associated with international money transfers. Transferwise is more than just a money transfer service provider; consider it a digital bank because it offers all the services that a bank provides. These services include holding money, receiving payments, making payments, and withdrawing money from ATMs. Despite only being a few years old, Wise has risen to become a major competitor to money transfer giants such as Western Union and MoneyGram.

If you want to send money to someone’s bank account, Wise (Transferwise) is the best option to use. Due to its vast network of banks in different countries, Wise offers speedy bank transfers. Here is how Wise works; Wise does not transfer money across borders; instead, they use their own money in their bank accounts in the destination country to complete the transfer. This allows Transferwise to provide low-cost money transfers.

Western Union

Western Union is the world’s most popular and oldest money transfer service. They have millions of customers worldwide and provide services in over 200 countries and territories. They have expanded over time by partnering with banks, retail businesses, and other financial institutions. Western Union also has over 500 000 locations worldwide. As a result, Western Union is the most accessible money transfer service in the world.

Western Union is the industry pioneer in cash transfers. If you want the recipient to receive the money in cash, Western Union is a great option to consider. With thousands of locations worldwide, Western Union can deliver money to almost anywhere in the world.

Transfer fees: Wise vs Western Union

The cost of the money transfer is the most important factor to consider when selecting a money transfer service. Let’s look at transfer fees in this section of the Wise vs Western Union comparison.

Transferwise charges a flat rate. Furthermore, Wise charges a commission fee that ranges from 0.2% to 3%. Most of the time, this variable fee does not exceed 1%. As a result, Wise is one of the cheapest companies for money transfers. Compared to other money transfer services, Wise is two to five times cheaper.

For example:

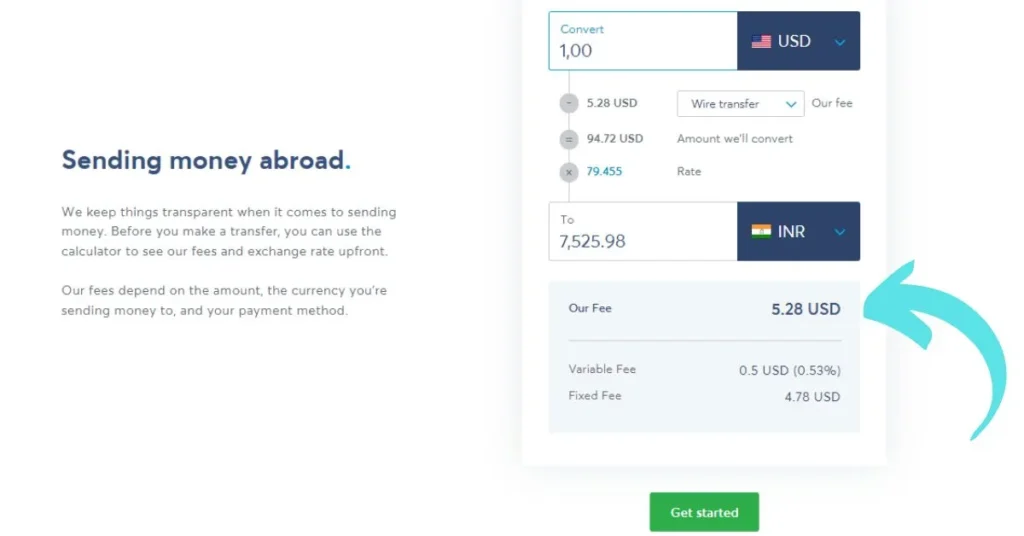

Here’s how much it costs to send $100 from the United States to India with Wise.

Here’s how much it costs to send $1000 from the United States to India with Wise.

Western Union, on the other hand, can be very cheap or very expensive depending on the payment and delivery methods you select. Western Union’s cash transfers are generally more expensive than bank transfers. They charge fixed fees for both cash and bank transfers.

The exact cost of a Western Union money transfer is difficult to determine because so many factors influence the cost of the transfers. For example, sending $100 from the United States can cost anywhere between $0 and $9, and sending $1000 can cost anywhere between $0 and $34. The cost is mainly affected by the payment and delivery methods.

Verdict: Wise wins. Wise is far less expensive than Western Union, though Western Union bank transfers are also cheap.

Which service offers better exchange rates, Wise or Western Union?

It’s important to select a money transfer service with the most favorable exchange rate. This is because exchange rates have a significant impact on the cost of money transfers. Most companies adjust the exchange rates. As a result, the cost of the money transfers increases.

Here’s how Wise and Western Union fare in this category.

Wise (Transferwise): Wise is very transparent about the exchange rate when sending money abroad. This simply means that when you make the transfer, you will know how much the receiver will get. Furthermore, Wise uses the mid-market exchange rate, which simply means that they do not adjust the exchange rate. They use the actual exchange rate as found on Google. This way, you will not pay more than the stated transfer fee.

Western Union: Western Union’s exchange rates are not always transparent. Western Union charges markup fees ranging from 0.4% to 5%. This simply means that they can lower or raise the exchange rate by 0.4 to 5%. However, this fee differs from country to country. The rate is also affected by payment and delivery methods.

Verdict: Wise wins. Wise does not charge exchange fees on international money transfers.

Transfer speed

Choosing a money transfer service that allows you to send money as quickly as possible is important, especially when the receiver requires the money urgently. Let’s compare Wise vs Western Union to see which company delivers money faster.

Wise: Speeds for money transfers when using Transferwise range from seconds to two days. However, if you send money to someone’s e-wallet or mobile money and pay with a debit/credit card, the money transfer will most likely be completed within minutes. If it’s to a bank account and pay with a bank deposit, the money should arrive in 1-2 days.

Western Union: People generally use Western Union for cash money transfers because they are faster. If the chosen delivery method is cash pick up or mobile money, the money transfer takes only a few minutes to be completed. If the delivery method is a bank deposit, the transfer can take up to five days. Money transfer speeds are usually affected by the payment method and differ from country to country. As a result, the time it takes to complete a Western Union money transfer will always vary.

Verdict: Western Union wins. Sending money via Western Union is much faster than using Wise, especially for cash pickup and mobile wallet delivery options. However, you should expect to pay more than you would with Wise.

Payment and delivery methods

It’s critical to understand how you’ll pay for the money transfer as well as how your recipient will receive the funds. Here are the payment and delivery options that Wise and Western Union accept:

Wise

Wise accepts debit/credit cards, Apple Pay, Google Pay, and bank deposits as payment methods. Transfers paid for with credit/debit cards are processed faster than transfers paid for with bank deposits.

Transferwise allows the recipient to receive funds in the following ways: bank deposit and mobile money. Mobile money transfers are instantaneous, whereas bank deposits can take up to two days.

Western Union

Western Union payment options include:

- Bank transfer

- Debit/Credit card

- Cash (Pay in-store)

Western Union offers the following delivery options:

- Cash pickup

- Debit card deposit

- Bank deposit

- Mobile wallet

Verdict: Western Union offers more payment and delivery options than Wise. Furthermore, Western Union allows people without bank accounts to send and receive money.

Which is easier to use, Wise or Western Union?

It’s crucial to know which firm is easier to use when considering whether to use Wise or Western Union.

Western Union offers simple cash transfers; To send money, simply walk into a Western Union store and give the name and country of the person to whom you want to send money. To receive money, the recipient only needs to provide the transaction tracking number (MTCN). Such transfers do not require many details. Anyone, regardless of whether they have a bank account or not, can send money using Western Union.

With Wise, you may send money directly to someone’s bank account or mobile wallet without leaving your house, which is convenient if you don’t want to leave the comfort of your home. You only need to go to the wise website and sign up, then follow a few simple steps to make the money transfer. Western Union also provides online money transfer services.

Verdict: Both Western Union and Wise are very easy to use. It all depends on the type of money transfer you want to make. Western Union is the best option to use if you want to pay in cash and have the receiver pick up the money in cash. Wise, on the other hand, is the best option if you want funds deposited directly into the recipient’s bank account or mobile wallet

Supported countries

Let’s see which company has a wider coverage in terms of countries of operation in this section of the Wise vs Western Union comparison.

Wise operates in over 80 countries. Money can be sent primarily from Europe, the United States, the United Kingdom, Canada, India, Australia, and many other countries. On the other hand, Wise delivers money to over 80 different countries. Wise accepts bank account deposits as a delivery method in all countries of operation. Wise also provides alternative delivery methods in other countries, such as mobile wallets.

Western Union, on the other hand, has global coverage, allowing you to send money almost to any part of the world. Western Union operates in over 200 countries. Due to having more than 500 000 stores worldwide, Western Union can deliver money to areas where no other money transfer service is able to deliver.

Verdict: Western Union has a wider coverage of countries compared to Wise.

Which company is safer, Western Union or Wise?

When sending money, people often want to know whether the money transfer service they intend to use is safe or not. If you’re wondering whether your money is safe with either Wise or Western Union, be rest assured that it is. Both companies are registered and regulated money transfer services. Furthermore, both companies take a lot of security precautions to protect their customers’ money. These safety precautions may include using encryption technology and requiring numerous verification processes.

Verdict: Both Wise and Western Union are safe ways to transfer money.

Customer satisfaction

After going through a lot of reviews, it was discovered that customers are typically satisfied with the services provided by both Western Union and Wise.

People like Western Union because it allows them to send money to anyone, regardless of whether they have a bank account or not. People are also pleased that they can send money to their loved ones within minutes. There have been some issues with the costs, though; most consumers thought they were paying too much for money transfers.

With an astounding 4.5/5 rating from more than 160 000 customers, it is undeniably evident that people are very happy with Transferwise. People on Trustpilot were quite happy with the services provided by Wise. Although some people don’t like the fact that you have to submit some documents to register an account.

Wise is the winner. Despite the fact that both companies provide excellent money transfer services, Transferwise has far more positive reviews than Western Union. To put it another way, people are far more satisfied with Wise’s services than with Western Union’s.

Conclusion: Wise vs Western Union | Which is Better?

Which money transfer service should I use? That is probably the main question on your mind. The decision to choose between Wise and Western Union comes down to personal preferences. Western Union is the ideal choice if you wish to send cash and have the recipient pick up the money in person. However, if we consider every factor that goes into a good money transfer, which should be cost-effective, best exchange rate, fast transfer speed, secure, and so on, the best of the two options for sending money is Wise.

Is there anything I forgot to mention or something unclear? Please share your thoughts in the comment section below.

Follow this guide to learn the 7 best ways to send money internationally.